French Election to Weigh on the Euro until The Fed Prepares for a US Rate Cut

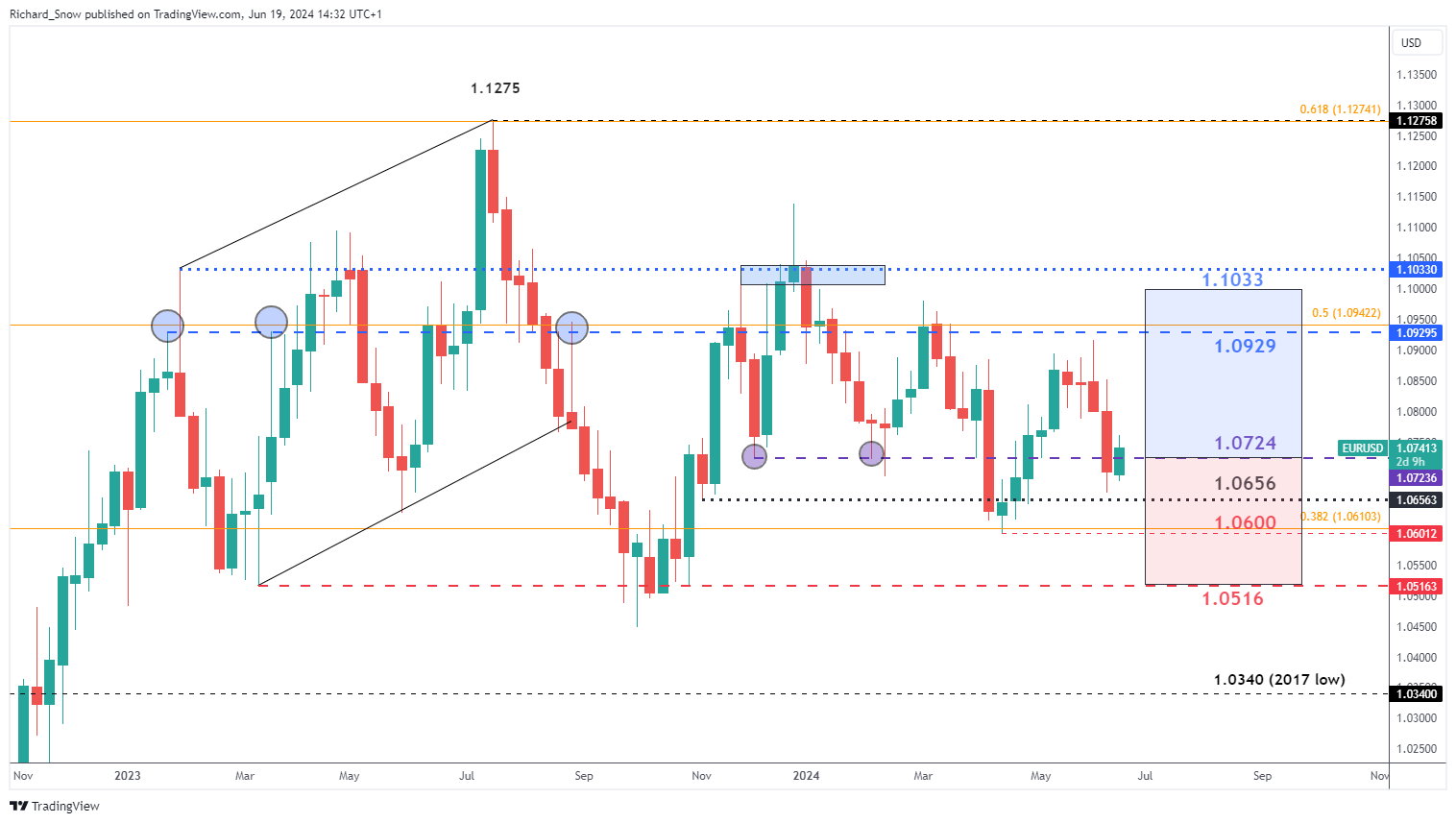

EUR/USD has exhibited a broad, choppy downtrend for 2024, moving back and forth in a reactive fashion as rate cut projections were clawed back significantly in the US and to a lesser degree for the ECB, hence the pair favouring the downside. In Q3, the euro may recover to some degree but remains fraught with uncertainty as French election concerns and Fed easing policy collide. Overall, the Fed story is expected to dominate even if the euro fails to exhibit broad strength when compared to G7 currencies.

As Q2 draws to a close, prices attempt to regain ground lost after the unexpectedly strong May NFP report and the Fed's hawkish inflation revisions in their June economic projections weakened the pair.

At the time of writing, the weekly chart shows Q2 closing around 0.0724, a level that provided support in late 2022 and February 2023. A significant upward move from here would be challenging and would likely require improved US conditions that more clearly indicate a potential September rate cut.

For EUR/ USD , a key resistance level lies just below the psychological 1.1000 mark, at 1.0929 – a point that repeatedly blocked advances in 2023. In extreme scenarios, 1.1033 could come into play, having capped weekly gains more recently. On the downside, 1.0600 is crucial if periphery bond spreads widen dramatically, with 1.0516 potentially becoming relevant thereafter.

EUR/USD Weekly Chart