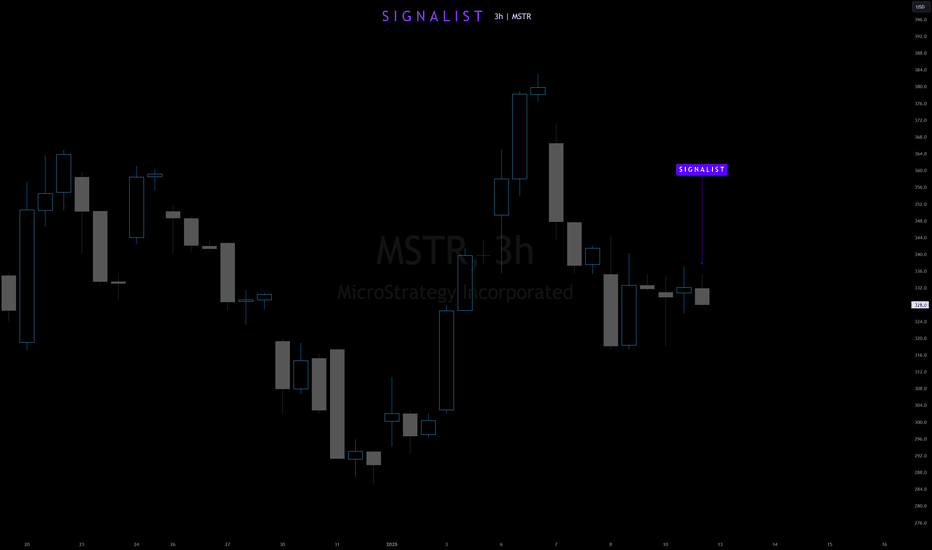

Major Price Movement Incoming for MSTR!

Signalist has detected a precise pattern in NASDAQ:MSTR trading activity, signaling that a substantial price movement is imminent. This isn’t a random fluctuation—it’s a carefully analyzed precursor to a significant market event. 📅 What to Expect: ⌛ Timeline: Anticipate a major move within the next 1 to 4 upcoming 3-hour candles. 📈 Monitor the Charts: Keep an eye on MSTR’s price action over the next few candles. Prepare Your Strategy: Whether you’re bullish or bearish, have your trading plan ready to capitalize on the move.

Read More