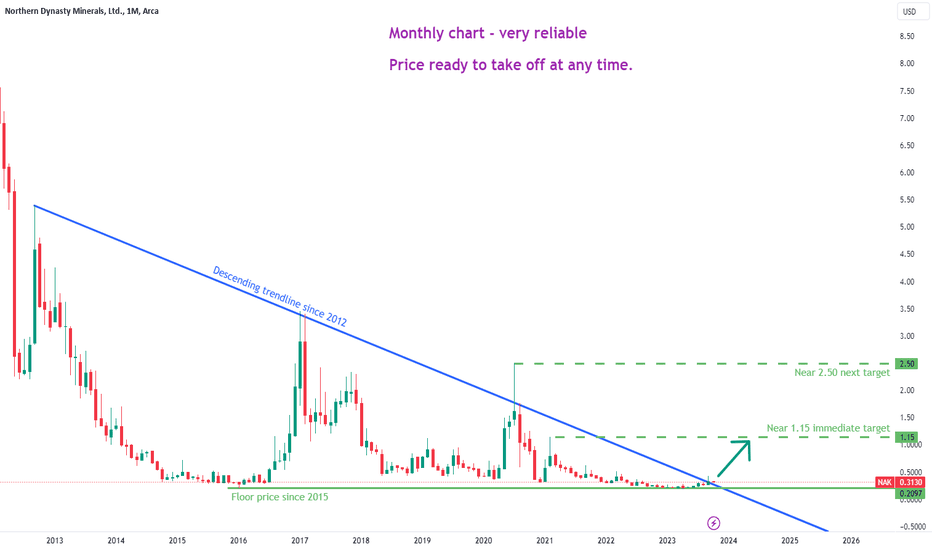

NAK Long-Term BULLISH

This is on the monthly chart and very reliable . NAK is nearing a total breakout of a descending trendline in place since 2012. In confluence with this, NAK has been staying around it's floor price for months now. It looks ready to launch from this base. TP #1 = 1.15 (should be easy to reach) TP #2 = 2.50 (likely to be reached longer term) SL = 0.19 Current price at time of this post is 0.313 Risk is only $0.123 per share, while reward for TP#1 is $0.837 per share, but the potential for TP #2 is high and this would be a reward of $2.187 per share!

Read More