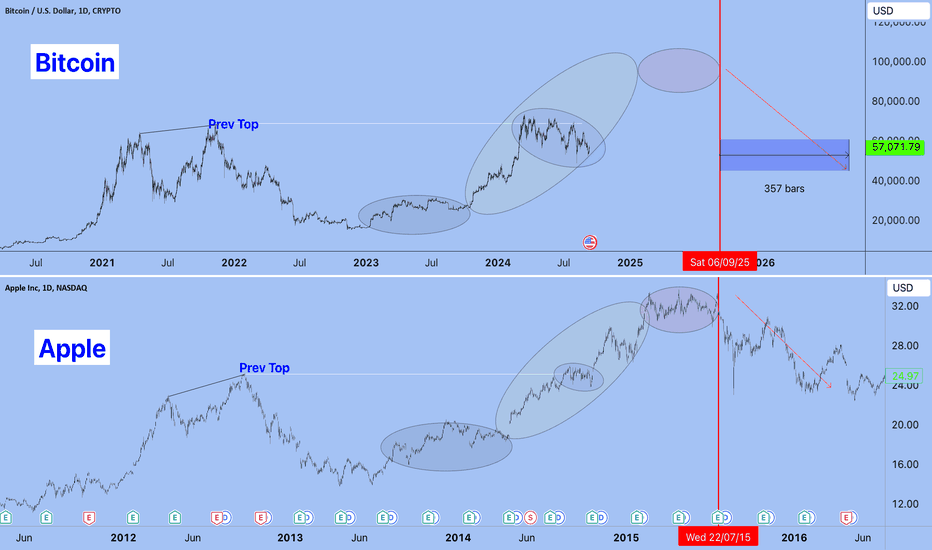

Galaxy Reveals 2025 Price Targets for Bitcoin, Ethereum, Dogecoin: Details

U.Today - 2024 was a monumental year for Bitcoin and digital assets. New price highs, record inflows, policy shifts and increased institutional adoption marked 2024. As the crypto...

Read More