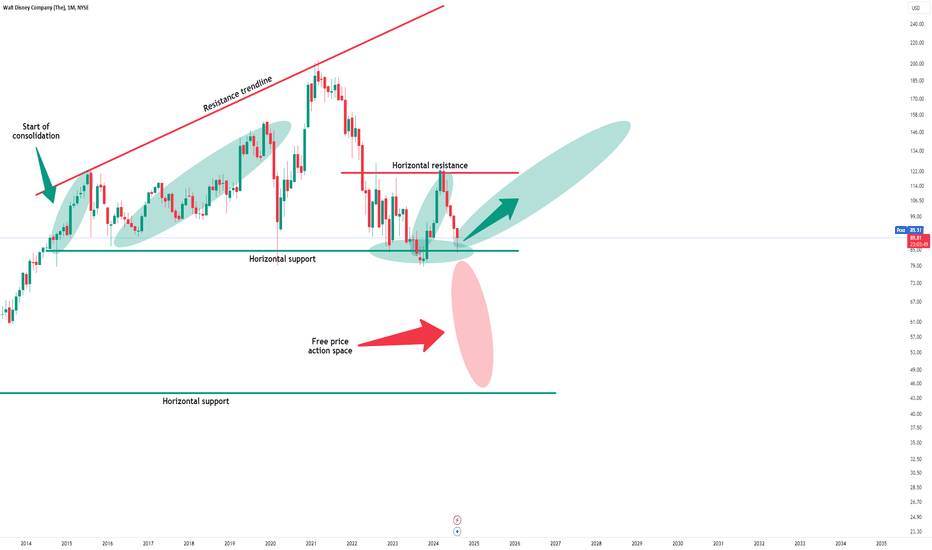

Disney - Don't Miss This Reversal Now!

Disney ( NYSE:DIS ) is about to retest strong support: Click chart above to see the detailed analysis👆🏻 Even though Disney has been consolidating for about 10 years now, it is still providing bullish trading setups. Especially the current horizontal support has been holding Disney above water and it is more than likely that Disney will create another bullish reversal away from this level. Levels to watch: $85 Keep your long term vision, Philip (BasicTrading)

Read More