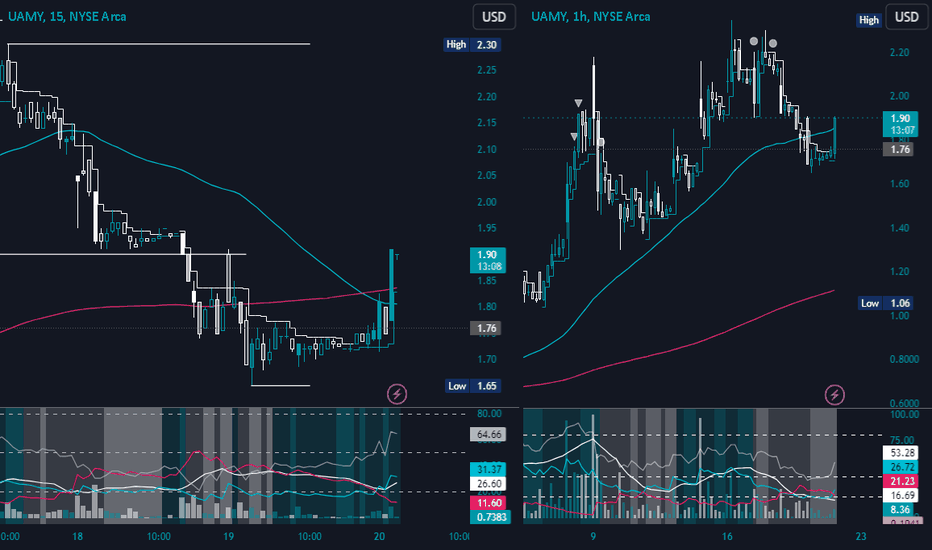

UAMY Ready for Another Run Up

I believe UAMY is ready for another run up now. According to SimplyWall.St, UAMY earnings are forecast to grow 158.07% per year and has had a very volitile past months compared to the US market. SimplyWall.St is a website I just discovered yesterday and I am glad to share it with everyone. It has a lot on a stocks fundamentals, going over risks and rewards, is very user friendly, and more importantly, is FREE. simplywall.st

Read More